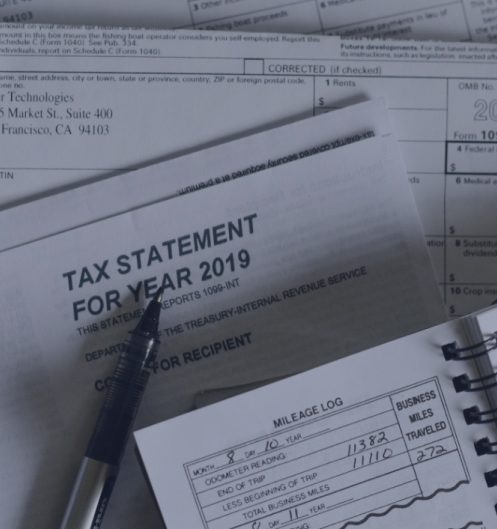

We know that tax problems are highly stressful, and they can also be financially, personally, and professionally devastating. When you have a complex tax problem, you need a New York tax attorney you can trust to work hard to protect your rights and interests. Our hardworking attorney, Timothy S. Hart, has the in-depth tax knowledge necessary to resolve even the most difficult federal and state tax issues. Whether you have unfiled tax returns, owe back taxes, need tax relief, are being audited, or have received a frightening notice that you are under criminal investigation for tax evasion, you can rely on Tim to provided strategic representation toward the goal of resolving your issue in the most beneficial way possible.

Our tax attorney takes on serious tax problems that threaten serious consequences. You can trust our law firm to work hard toward getting you a satisfactory outcome and bringing you peace of mind.

We represent individuals and businesses who are facing conflicts with the Internal Revenue Service or the New York State Department of Taxation. Contact our effective and experienced New York tax lawyer when you need help.

Tim Hart has the skill and experience necessary to resolve complex tax issues. He is admitted to practice in the U.S. Tax Court and is a member of the American Institute of Certified Public Accountants and the New York Bar Association. He is a graduate of Widener Law School, a cum laude graduate of the Masters in Taxation program at the University at Albany, and a cum laude graduate of New York’s Siena College.

Tim will put his strong tax knowledge to work to protect your rights.

Learn why you should choose Tim Hart.