Alter Ego Liens and Levies: How to Protect Your Assets

October 10, 2025 | Tax Laws Tax Levy Tax Liens Tax Relief

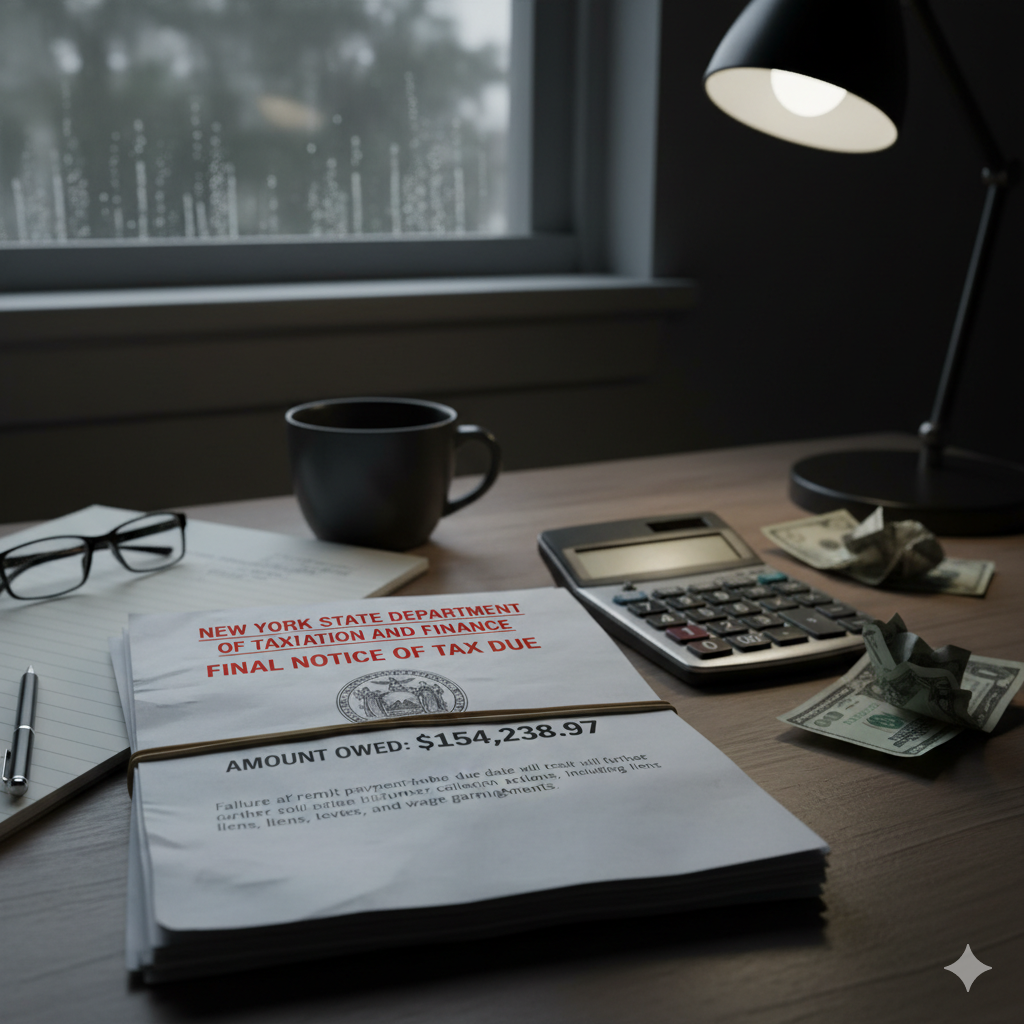

What Is an Alter Ego Levy and How to Protect Your Assets? An alter ego levy is when the IRS seizes assets owned by your alter ego to cover your tax debt. If you've received notice of an alter ego lien or levy, you need to take action – this is not routine tax debt collection, and generally, the IRS only pursues this route when they believe you are hiding assets or they have the right to pierce the corporate veil due to co-mingling. To protect yo... CONTINUE READING