What Happens to Transferred Assets When You Owe Back Taxes?

22 November, 2025 | Tax Debt Tax Liens

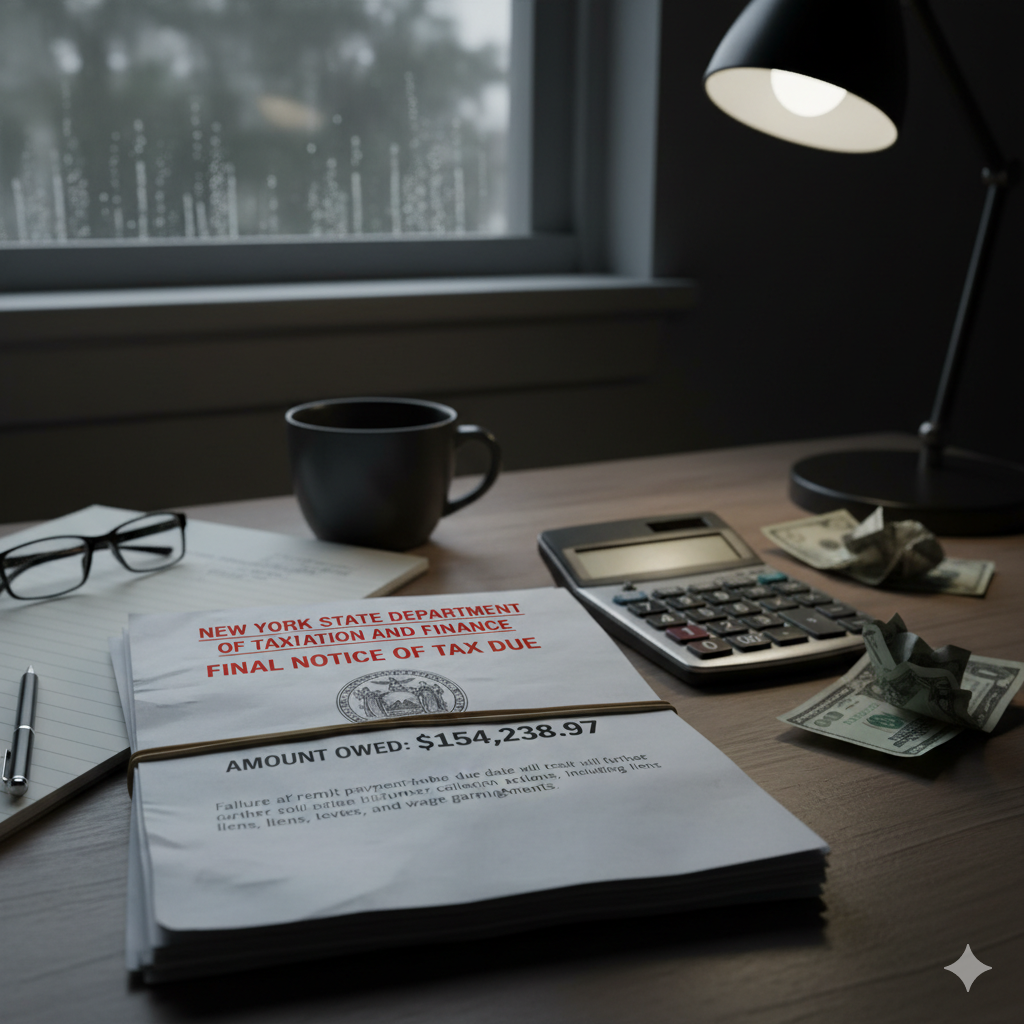

What Happens to Transferred Assets When You Owe Back Taxes? When someone owes back taxes to the IRS and tries to transfer assets, the consequences can be severe for both the person who owed the taxes (the transferor) and the person or entity who received the assets (the transferee). The IRS and other taxing authorities possess sweeping powers to trace, reclaim, and penalize improper asset transfers meant to sidestep tax debts. Explo... CONTINUE READING